Vendasta’s CMO Jeff Tomlin on metrics that matter and how to mitigate risk in a recession

With more than 20 year of experience in this area, Vendasta’s Co-Founder and Chief Marketing Officer Jeff Tomlin shares his expertise in metrics that matter in a recession. It's a really important topic right now especially as economic conditions change and become tougher. What are the metrics that matter to your business and how can you mitigate risk?

There’s talk of an impending recession and increasingly tougher economic times on the horizon. This downturn impacts local businesses, which then impacts service providers like marketing agencies. The famous management consultant Peter Drucker once said, "If you can't measure it, you can't improve it." So what do you need to be looking at as an agency owner in order to ensure you're driving sustainable growth? We’re digging into the metrics that agencies need to monitor right now.

“I like to simplify the way that we think about how to diagnose our business and ensure that we keep operating efficiently and effectively, and continue to grow as we weather the recessionary times,” says Tomlin. “Probably the most important thing when you're keeping it simple is to understand the customer and how the customer's needs are changing.”

Tomlin drives home the importance of customer-centric thinking as this sets apart successful and unsuccessful businesses. It's critical to understand how the profile of your ideal customer is changing as the market changes.

“I'll give you an example of what we had to do when COVID hit. That was a big change in the market and we sat back and looked at the market conditions. We saw, number one, there was a huge need for remote work and remote work tools as well as e-commerce tools. They needed to be integrated in the platform. There was also a huge demand for e-learning, and that's where our academy and community were really prioritized.”

Essentially, Vendasta paid attention to our customers' needs as things changed rapidly in 2020. You can’t always be proactive; sometimes, it’s best to wait and see where demand is and then react accordingly.

According to Tomlin, “As an agency owner, the number-one thing that you should have a really clear view on at all times is what your ideal customer profile looks like. As times change, you have to reevaluate that customer profile to see how the customer is changing and how that affects their needs.”

As your customer profile changes, agencies should consider the following four questions:

- Can you still serve customers efficiently?

- Do they still have the same urgency to buy?

- Do they still have the same willingness to pay?

- Do they still have the same willingness to engage, and how is that changing?

How to adjust as your customers’ needs change

So how does an agency owner and their team go about understanding what is and isn’t working for them? And how do you shift your focus with fluidity so that you don’t lose customers?

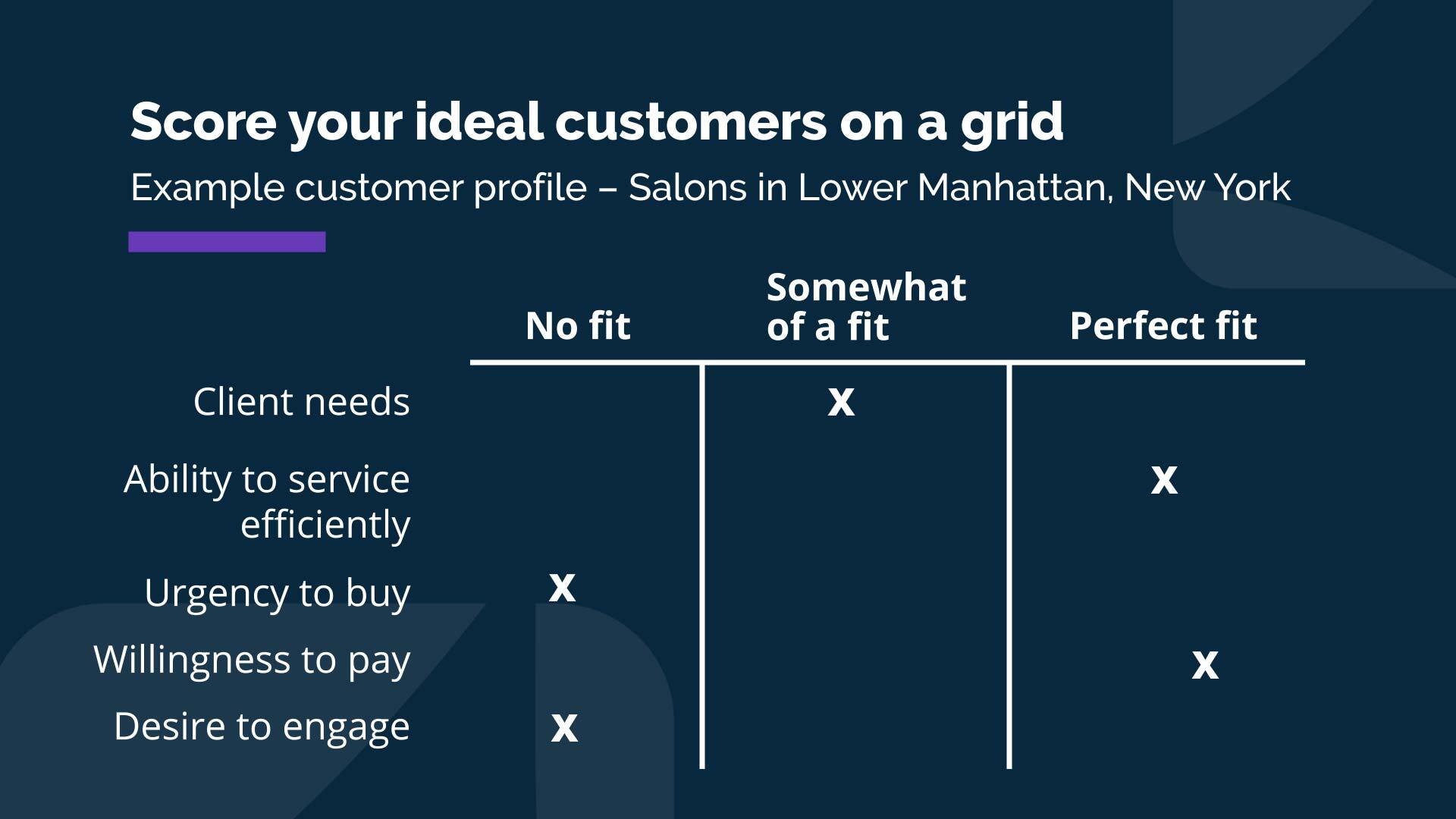

Tomlin explains, “There are practical metrics to measure those things. I’d recommend building out a grid so that you can visualize a box where you have ‘no fit,’ ‘somewhat of a fit,’ or ‘perfect fit.’ Along the vertical, put down those four categories: Can you serve customers efficiently? Do they still have urgency to buy? Do they still have the same willingness to pay? Are they still engaging with you, and how is that changing?”

Drawing this out can give you a clearer picture of your customers and their fit with your agency as things evolve. Customer retention is really important at any point in time, but it’s especially important when businesses are really buckling down their expenditures due to the economic downturn. The cost of acquiring a new customer is up to five times more than retaining an existing one (OutboundEngine).

“Look at your inbound funnels. How are your funnel metrics changing? Customer churn will give you an idea of big changes in their needs,” says Tomlin.

Can you still serve customers efficiently?

There are a number of factors to consider when asking if you’re still able to serve customers efficiently.

“Have an understanding of what your cost to serve a customer is, and how that’s changing. So cost to serve is typically your account executives, your support people, the gross cost of maintaining your software, and your gross margin. Those all together give you a picture of your costs to serve a customer,” Tomlin explains.

The combination of these factors will help you evaluate how things are changing.

Do they still have the same urgency to buy?

The number-one place to look when evaluating urgency to buy is the sales cycle. “Is time in your sales cycle changing? If your sales cycles are lengthening out, you know that the urgency of your customer has to be addressed,” says Tomlin.

This is a tell-tale sign that customers are losing their urgency to buy because of any number of reasons. The most likely reason is budget.

Do they still have the same willingness to pay?

When measuring whether customers still have the same willingness to pay for your products and services as they did previously, you’ll have to turn to your sales team.

“Look at your average deal size,” says Tomlin. “The bookings that your sales team has, how is that changing?”

Do they still have the same willingness to engage, and how is that changing?

Again, the sales team is going to be the best place to look when measuring engagement. “Take a look at your win/loss rates and put them on a scale to see how they've changed over time,” explains Tomlin.

A comprehensive look at all of Tomlin’s recommended metrics that matter will give you an idea of how your customer profile is changing. Once you have a solid understanding of your customer’s evolution, you’ll either have to reposition your business or refocus on a new customer group.

How to improve your win/loss ratio

For different agencies, markets, and geographies, the nuances of a good win/loss ratio are most likely different. But is there an ideal number that agencies should be targeting for these metrics? And more importantly, how do you improve all the metrics that matter? How do you achieve a better win/loss ratio? How do you make customers more willing to spend their hard-earned money on your products and services?

Tomlin addresses all of these questions with the answer, “it depends on the business.”

“If you're selling to mid-market businesses, you should be recovering your sales and marketing costs faster. If you're selling to enterprise-level businesses you can recover your costs further down the road because the lifetime value of those customers is different. So what makes a good metric depends on the type of customer that you're serving,” says Tomlin. “I would say that there's a category of metrics that you could think of as risk metrics. And so as we're going into a recessionary time, risk is an extremely important thing to manage. Some companies might have a larger willingness to accept risk given their ability and access to capital.”

How agencies can measure and mitigate risk

Risk is more manageable for some industries and agencies than others, but every business has to deal with it. Tomlin outlines three ways for agencies to measure and manage or mitigate risk appropriately.

“The best practice for many businesses right now (especially in the software space), but I think it's just as applicable for marketing agencies, is to manage to a rule of 40. A rule of 40 is this balance between profitability and growth. The calculation is that your growth rate plus your profit margin should equal 40. So some companies, if you're growing a lot faster, you can accept a lower risk on your profit margin. Or if your business is very profitable you don't necessarily need to grow quite as fast.”

Previous to this recession, growth was highly valued, even more so than profitability. “When the economic times change, suddenly the viability of your business and the stability of the business is more important than growth. And that's why more and more companies now are managing to the rule of 40.”

Secondly, Tomlin looks at the cost of acquisition payback period. We’ve already looked at cost of acquisition vs cost of retention, but you don’t want to put the brakes on acquiring new customers.

“The cost of acquisition payback period is a measure of how many months it will take to pay back your sales and marketing costs. Compare your average basket size for a customer against your gross margin, and measure that against your total sales and marketing costs. This will give you a payback period,” explains Tomlin.

This plays into Tomlin’s initial remark of “it depends on the business.”

“If you're selling to enterprise, you could pay back your sales and marketing costs in 18 to 24 months maybe. But if you're selling to smaller businesses that typically have higher churn rates, you want to recover your costs in 12 months or less. And so it depends on who you sell to. But at the end of the day, you want to determine your typical benchmark for how long it takes to recover your costs. In order to manage your risk, you want to see if you can move those down and recover your costs faster. There are many ways to do that, like upfront commitments and so forth.”

Tomlin’s third metric is based around sales efficiency. Getting your customer to commit to you for a longer period of time isn’t always an easy task, but the longer you can get them to sign for, the less risk you’re taking on as an agency.

“Many businesses try to get annual commitments. A lot of them are monthly commitments, but annual commitments are a great way to manage risk just by getting your customers to pay you upfront. It helps you manage churn. But a metric called the CAP ratio measures the efficiency or the cost to generate one dollar of annual recurring revenue,” says Tomlin. “Typically, an industry benchmark has said you’re in a good spot if you can spend a dollar to generate a dollar of annual recurring revenue. But you want to be able to measure that over time and say, ‘How is our sales and marketing efficiency changing now?’ And take the corrective course actions if it's suffering.”

In summary, Tomlin’s three recommended risk management metrics that matter are:

- Manage by the rule of 40

- Look at the cost of acquisition (CAC) payback period

- Measure your sales efficiency with the CAP ratio

A CMO’s advice to get through the recession

With Tomlin’s years of experience in marketing, he’s weathered the tech crash of the early 2000s, the global financial crisis, the COVID pandemic, and now this recession. His advice to agency owners facing the current economic climate comes with some weight.

“First, one of the principles that we've always had as a leadership team around here is frugality. And it's been frugality because we've been through all sorts of different cycles and seen a lot. You never know when a change is going to happen. You always want to be wise with your money. That's just a good rule all of the time,” says Tomlin. “Another thing is that when times change, it creates a lot of hardship for businesses, but it also creates a lot of opportunities. I find that, often, when times change like this, people focus on managing the problems instead of looking for the opportunities. And oftentimes, a lot of opportunities to grow come out of difficult environments.”

Keep your eyes peeled for opportunities and look beyond the difficulties right in front of you. Know the metrics that matter and what to pay attention to, and how to measure them so that you can mitigate risk and grow your agency while you survive the recession.

[adrotate banner="287"]